A high-level overview

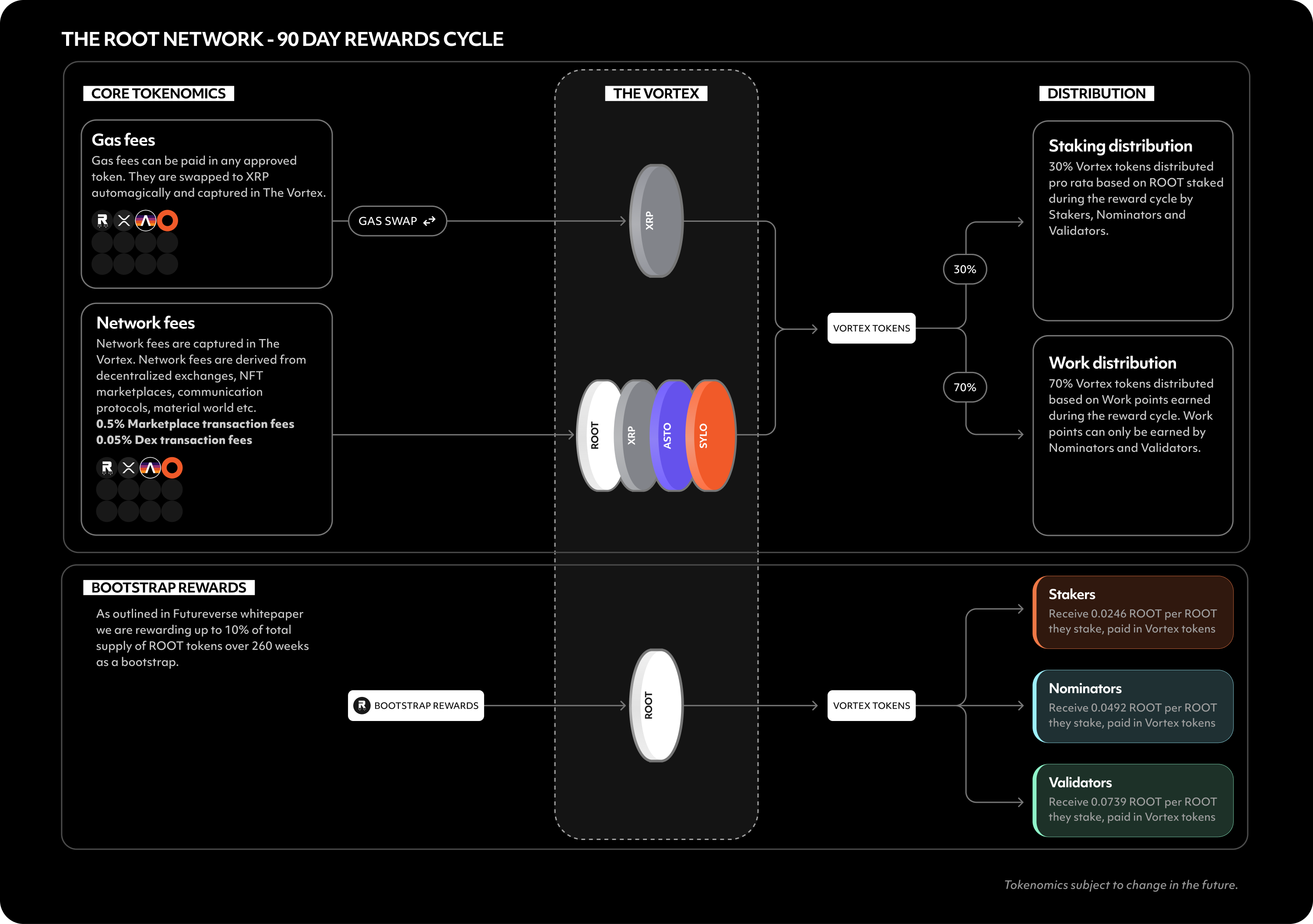

- Gas and network fees accumulate during the reward cycle (90 days).

- These fees are transferred into The Vortex at the end of the cycle, and Vortex tokens are minted to reward participants based on their participation level.

- Participation level is based on two things:

- (a) The amount and duration of ROOT staked, and

- (b) The work done as a validator, measured in Work points

- Vortex tokens can be redeemed anytime, releasing the underlying tokens in The Vortex to the holder.

ROOT Token Economy

Several key use cases drive the ROOT token economy:Governance of The Root Network Protocol

ROOT is the network governance token. It will control core features like software upgrades, runtime upgrades and new runtime deployments, the block reward economy, and admitting new application chains who wish to use The Root Network hub.Proof-of-Stake for Network Security

ROOT is also the network token node validators and delegators use to secure the Proof-of-Stake network. Validators or delegators who stake ROOT will earn fees from various network activities to ensure there is sufficient incentive to operate a node and stake. The block rewards for staking can come in several forms.- Gas spent in the network is distributed to block producers—the default Gas token.

- XRP provides validators with instant real value for producing blocks.

- Initial bootstrap pool: 10% of the ROOT tokens will be distributed to block validators and stakers over the first 260 weeks.

- Fees generated by the various network runtime activities. Including:

- NFT trading fees from the Non-fungible Asset runtime

- Token minting fees in the Fungible Asset runtime

- Trading fees for the DEX and the Gas Fee Exchange

Futureverse Utility and Game Economy

ROOT is the primary in-game token for the Futureverse game ecosystem and can be used for a range of things such as, but not limited to:- Land reward mechanics

- Game rewards

- Stake to earn content

- Charging up in-game items

- Breeding

- New content purchases

- Stake to play

Data Marketplace

ROOT can be used to incentivize individual and community-owned-and-controlled data sharing with third parties via the Token Service platform. As it’s a fungible token in its own right, ROOT can, be used for any other type of utility. Developers can leverage the liquidity and community of ROOT to bootstrap their own activities and games. The nature of the multi-token economy means that the ROOT holder community can get access to these tokens via staking in the network.How are tokens distributed?

The ROOT token supply is 12,000,000,000 tokens and will be distributed in several pools.- Community Rewards - 20% Each month, ecosystem challenges will be set on The Root Network, each with a number of rewards available. The total number of rewards per player will be determined by their FutureScore. The FutureScore is powered by FuturePass technology. It is calculated based on specific criteria, which include the type of assets you hold, the number of collectibles in your possession, the duration of your ownership, the rarity of those assets, and the activities those assets have been involved with. Additionally, the score takes into account other valuable contributions players have made to growing the ecosystem, such as social media activity. The score is dynamic, will evolve over time, and will be influenced based on your participation.

- Land Mechanics – 20% 20% of the tokens will be allocated to game mechanics within The Third Kingdom. The upcoming Third Kingdom whitepaper will release more details on how this will work.

- Ecosystem Development Fund – 10% 10% of the tokens will be allocated to encourage new developers, artists and IP rights holders to build on the network.

- Block Reward Bootstrap - 10% Validators and stakers will receive up to 10% of the tokens over 260 weeks as a bootstrap, while the token fee economy gets up to speed.

- CENNZ Burn to Mine - 10% Many of The Root Network’s runtimes and technology have resulted from our collaboration with the CENNZnet team. We are rewarding CENNZ token holders with the ability to burn their CENNZ tokens into The Root Network and, over time, receive 1 ROOT for each CENNZ in a 1:1 ratio.

- Futureverse – 15% As the core developer, the Futureverse company will hold 15% of the tokens. They will be locked for 100 weeks and then vested for a further 100 weeks.

- Liquidity providers - 5% Liquidity providers will be eligible for up to 5% of the tokens.

- DAO treasury 5% The Treasury will manage a further 5% of tokens (among other tokens retained within the Treasury). These tokens will be locked for 50 weeks. The DAO will control their allocation.

- Advisors - 5% Our core advisors and those who have brought significant IP to the network will receive 5% of the tokens. They will be locked for 100 weeks, then vested over 100 weeks.

How are rewards distributed?

All rewards on The Root Network are distributed as Vortex tokens. Vortex tokens are tokens that can be redeemed to release a corresponding percentage of tokens that are in The Vortex. Two types of rewards contribute to The Vortex each reward cycle: Bootstrap Rewards and Gas and network fees.- Bootstrap rewards

- As outlined above, Bootstrap rewards account for up to 10% of the total supply of ROOT tokens over 260 weeks to early backers and supporters.

- This is distributed based on ROOT tokens an individual has staked by duration in the reward cycle.

- Individuals receive ROOT per ROOT they stake

Stakers: 0.0246 | Nominators: 0.0492 | Validators: 0.0739

- Individuals receive ROOT per ROOT they stake

- At the end of the reward cycle, The Root Network calculates the Bootstrap Reward for each participant type, transfers it into the Vortex, mints Vortex tokens, and distributes them to participants.

- Rewards from gas and network fees

- This reward pool is based on gas and network fees collected. At the end of the reward cycle, these fees are used to mint Vortex tokens to reward participants.

- 30% of these Vortex tokens are distributed to stakers, nominators and validators. The distribution is based on the amount and duration of their staked ROOT relative to the total ROOT staked and its duration by all participants.

- The remaining 70% are distributed to validators and nominators based on their proportional Work points earned throughout the reward cycle.

Example Scenario

ROOT Price = $0.005Vortex Price = $0.15 Staker

I’m a Staker, I have staked 50,000 ROOT without nominating for the duration of the cycle.

- Bootstrap Reward = 0.0246 x 50,000 (ROOT Staked) = 1,230 ROOT

- Paid out in Vortex = 1,230 x 0.005 (ROOT Price) / 0.15 (Vortex Price) = 41 Vortex tokens

I’m a Nominator, I have nominated my stake of 50,000 ROOT to someone else’s validator node for the duration of the cycle.

- Bootstrap Reward = 0.0492 x 50,000 (ROOT Staked) = 2,460 ROOT

- Paid out in Vortex = 2,460 ROOT x 0.005 (ROOT Price) / 0.15 (Vortex Price) = 82 Vortex tokens

I’m a Validator, I have staked 50,000 ROOT to my own Validator Node for the duration of the cycle.

- Bootstrap Reward = 0.0739 x 50,000 (ROOT Staked) = 3,695 ROOT

- Paid out in Vortex = 3,695 x 0.005 (ROOT Price) / 0.15 (Vortex Price) = 123.16 Vortex tokens

How are the Vortex token mints calculated?

At the end of each reward cycle, the protocol determines the value of the tokens added to the Vortex. It also divides the value of The Vortex itself by the number of Vortex tokens in circulation. These numbers are used to calculate the amount of new Vortex tokens to mint and distribute as rewards to participants.What are Work points? And how do they work?

- Work points are earned by validators for doing work to complete blocks and transactions on the network.

- As a nominator, you earn a percentage commission of Work points your selected validators earn.

- At the end of each Era (24 hours), you will see an estimate of your Work points on the staking dashboard.

- If you are a staker only (i.e., did not nominate a validator), you do not earn any Work points.

- Work points do not directly translate to Vortex tokens. See above for how reward distribution is calculated.

How are Work Points Calculated?

At the end of each 90-day reward cycle, work points are assigned to validators based on their total staking rewards earned. These rewards reflect both the validator’s commission and their share of staking rewards based on self-stake. The data is pulled directly from TRN’s on-chain staking pallet.- Start with the validator’s total reward points for the era, which come from their overall performance.

- Apply the validator’s commission rate to determine how much they earn directly.

- The remainder of the reward is shared proportionally among the validator and their nominators, based on stake.

- Calculate how much of this shared reward the validator keeps by looking at how much of the total stake they personally contributed.

- Add the commission and the proportional reward to get the validator’s total payout.

staking.erasRewardPoints: The total reward points for the validator in the current era.staking.erasStakersClipped: All staked tokens for the validator, including it’s personal stake.staking.validators: Provides access to the commission rate for the validator, expressed as a percentage.

How are Partner Attributions Applied?

At the end of each 90-day reward cycle, each partner account will receive a percentage of the Vortex tokens that were included in the pool due to their attributed Pass contributions based on gas fees attributed to that Partner.- At the end of the cycle, the price of XRP that’s used for Vortex calculations is $2.57 USD.

- Let’s say that 20 XRP was paid in gas by Pass addresses attributed to partner 1.

- 20 XRP * 2.57 = $51.40 is the Partner Attributed XRP value in USD

- The fee pot value in USD is $30,113.658826 (This is derived from total network vtx * vortex price ). To get the % of that partner’s attributed fees based on USD 51.40/30113.657726 = 0.001706866714 as Partner Reward Ratio

- At the end of the cycle, if we assume the amount of Vortex driven by network fees to be minted is 188,225 VORTEX. This means that the VORTEX attributable to the partner is 321.274987 VORTEX (0.001706866714 of 188,225).

- Therefore 1% (Partner Fee Percentage On Chain) of 321.274987 = 3.212749 Vortex

How to Stake or Nominate?

Note: You require ROOT tokens in your FuturePass to participate in staking or nominating. To bridge your ERC20 ROOT from an Externally Owned Account (EOA) account to your FuturePass address (e.g 0xffff) see, Ethereum Bridge.

- Go to the staking site: staking.therootnetwork.com.

- Click Start Staking.

- Sign in to your FuturePass. Your available ROOT balance is on the staking dashboard in the top right corner.

- Click Stake ROOT.

- Enter the amount you want to stake.

- If nominating, select one or more validators and then ‘Confirm selection’. If only staking click ‘Skip nomination.’

- You’ll see a confirmation about staking. Review it, and if satisfied, click ’ Stake ROOT.’

- Click ‘Continue’.

Frequently Asked Questions

- How do I unstake?

- Unstaking is a two-step process. First, you need to unstake your ROOT, which will lock it for 28 days. After the 28-day period, you can then withdraw your unstaked ROOT.

- What happens if I unstake before the end of the reward cycle?

- If you unstake before the end of the reward cycle, but don’t withdraw you will receive rewards at the staker rate for that portion.

- If you unstake and withdraw before the end of the reward cycle, you will not receive any rewards for that portion.

- When does my Validator commission get applied?

- The validator commission is applied at the end of the reward cycle. The commission is deducted from the total rewards earned by the validator, and the remaining amount is distributed to nominators based on their stake. see How are Work points calculated?

- Why are payouts inconsistent between cycles?

- Many factors can affect the payouts, including the amount of ROOT staked, the number of tokens in The Vortex and the USD value of the tokens at the time the cycle ends. These factors combine to determine the number of Vortex tokens minted and distributed to participants.